A recent Wall Street Journal article found that there are 1,135 billionaires in the United States. The piece focused on how much wealth billionaires hold but told us little about the economic role they play. That role is crucial, although many people do not seem to understand it. New York City mayoral candidate Zohran Mamdani said, “I don’t think we should have billionaires.”

To help Mamdani and others confused about billionaires, here is a brief overview on how they gain their wealth, what it consists of, and how they use it to spur economic growth.

How Billionaires Gain Their Wealth

The Journal finds that two-thirds of US billionaires have self-made wealth, while just one-third inherited much, or all, of it. Ryan Bourne and I came to similar conclusions in our study on wealth. Generally, American billionaires build their wealth by succeeding in finance, technology, real estate, manufacturing, retail, and other competitive industries. Most of America’s wealthiest people are entrepreneurs who built their fortunes.

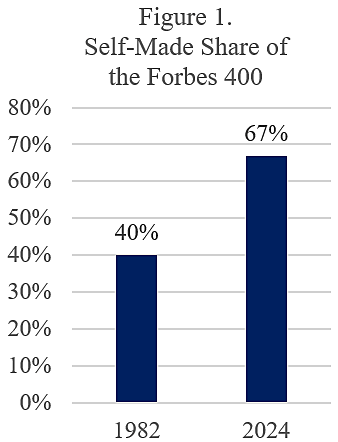

More good news is that the share of America’s wealthiest people who are self-made has risen. Figure 1 shows that the self-made share of the Forbes 400 wealthiest Americans increased from 40 percent in 1982 to 67 percent by 2024. That increase reflects beneficial dynamism in our economy. There has also been a large turnover in the top 400 over time as new business innovations and fortunes supplant past ones.

Critics ignore this dynamic process of wealth-building. Senator Bernie Sanders complained that “in the last four decades, there has been a massive shift of wealth from the middle class to the top one percent.” That is faulty zero-sum thinking. In many industries, America’s wealthiest people have created new products and new industry competition to generate widespread gain. When businesses innovate, the great majority of the benefits accrue to consumers and the general public.

Senator Sanders makes a useful critique when he calls billionaires who swarm around politicians an oligarchy. But he paints with too broad a brush. Bourne and I discuss the difference between billionaires gaining wealth by political cronyism and billionaires gaining wealth by creating value in open markets. The good news is that America’s billionaires are mainly value generators.

The bad news is that rising economic intervention by both parties in Washington threatens to create more ill-gotten gains at the top. Billionaire Ken Griffin is right in criticizing President Donald Trump’s policies: “Tariffs open the doors to crony capitalism. The government starts to pick winners and losers.” Senator Sanders is right to “fight oligarchy” if that means repealing tariffs, special protections, and subsidies for billionaires and big corporations.

What Billionaire Wealth Consists Of

The Journal story said that the 1,135 billionaires own $5.7 trillion in assets, but it did not detail what those assets are, other than to say they include 3,000 homes. Many articles in the Journal have focused on the mansions, yachts, and airplanes owned by the rich. But those personal assets are a sideshow in understanding the role of billionaires in the economy.

The main thing that billionaires own is equity in private and public businesses. In this role, billionaires support capital investment, opportunities for workers, and growth in the US economy. Billionaires save and reinvest the vast majority of their wealth, which benefits the overall economy. It is better for the rest of us if billionaires save rather than consume, and that is what the data show they do with nearly all of their wealth.

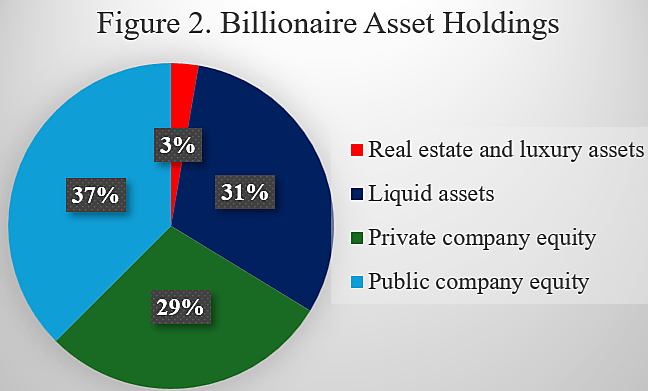

Figure 2 shows the assets held by billionaires, based on data from Altrata’s “Billionaire Census” for 2024, which is the source the Journal used. Ownership of business equity accounts for 66 percent of billionaire wealth, liquid assets account for 31 percent, and “real estate and luxury assets” account for just 3 percent. Altrata includes items such as art, jewelry, and automobile collections within luxury assets.

Critics such as Senator Sanders complain that wealth is “concentrated.” But the wealth of billionaires is mainly dispersed widely across the economy in productive business facilities. Consider Jeff Bezos. His many expensive homes may be considered concentrated wealth. But his homes account for less than half a percent of his wealth, most of which consists of his part ownership of Amazon. The company that Bezos founded in his garage now employs more than one million Americans in operations spread widely across the country, which serve more than 100 million US consumers.

Bezos has a self-made fortune, but it is also laudatory when billionaire families successfully manage and grow inherited businesses. Whether wealth is self-made or not, it benefits all of us when it is carefully invested and nurtured in productive business enterprises. Wealth is a good thing. The economy would not grow without it.

How Billionaires Spur Economic Growth

The Journal article says that US billionaires have donated $185 billion over the past decade to philanthropic causes, such as education and medical research. Such commendable efforts are often called “giving back” to society.

However, the wealthy invest in many other ways that benefit society. In this study, I examined how wealthy individuals are major funders of start-up companies. Wealthy “angels” invest in long-term, high-risk business ideas that others do not, and they have helped birth many of America’s greatest companies.

The Journal mentions billionaires Jeff Bezos and Bill Gates. Both have funded dozens of startup companies in areas such as space exploration, nuclear energy, renewable energy, and biotechnology. The Journal also mentions Selena Gomez, who is an actress and singer but also a billionaire business founder and angel investor. She founded Rare Beauty Brands, co-founded Wondermind, and is an angel investor in such companies as Serendipity Brands and GoPuff.

Billionaires feed “oligarchy” when they lobby politicians to restrict competition. But wealthy angels do the opposite by funding startups that create competition. Angels such as Bezos, Gates, and Gomez are “giving back” to the economy by seeding growth in entrepreneurial companies that challenge incumbent businesses.

Zohran Mamdani says that he wants to reduce costs for New York City families. He should know that the greatest benefactors of lower-income families are the entrepreneurs who built fortunes slashing consumer prices. Sam Walton and Henry Ford are famous examples. More recently, brothers Theo and Karl Albrecht built their fortunes slashing grocery prices even lower than Walmart through their Aldi stores. Rather than government-run supermarkets, Mamdani, if he wins, should slash taxes and zoning rules to bring more Aldi stores into New York City.

In sum, billionaires are doing more important things for the economy than buying mansions and yachts. News organizations should explore how they are investing the other 97 percent of their wealth.

Data Note: I calculated the asset shares in Figure 2 based on Altrata asset share data that is presented separately for men and women.